How a Wind Mitigation Inspection Can Lower Your Florida Insurance Premiums

How a Wind Mitigation Inspection Can Lower Your Florida Insurance Premiums

Home insurance rates in Florida have climbed higher than almost anywhere else in the United States, and many homeowners don’t realize they’re missing out on discounts that already exist within their homes. A wind mitigation inspection—often called a “wind mit”—is one of the easiest and most reliable ways to lower your premium.

This inspection identifies the wind-resistant features of your home and documents them for your insurance company. The stronger your home is against severe wind and storms, the more you can typically save.

If you own a home in Central Florida, here’s exactly how a wind mitigation inspection works and why it can put real money back into your pocket.

What Is a Wind Mitigation Inspection?

A wind mitigation inspection focuses specifically on how well your home can withstand strong winds, such as those seen during tropical storms or hurricanes. It is not a full home inspection—this one looks only at structural features that reduce wind damage.

We evaluate:

-

Roof age and materials

-

Roof shape

-

How the roof is attached to the home

-

How the roof decking is nailed

-

Whether you have a secondary water barrier

-

Whether windows/doors/openings are impact-rated or protected

Your insurance company uses the results to calculate potential discounts.

Why Insurance Companies Offer Discounts

Stronger homes get hit with less damage. Less damage means fewer claims.

So Florida insurers reward homes built—or upgraded—with wind-resistant features.

A single wind mitigation inspection can save:

-

$150–$1,500+ per year, depending on your home

-

Thousands over the lifespan of the policy

And the best part:

Your wind mit report is valid for 5 years.

What We Look for During a Wind Mitigation Inspection

Below are the most important components we evaluate and how each one impacts your insurance rates.

1. Roof Age

Insurers look closely at roof age because newer roofs resist wind better.

Typical guidelines:

-

Shingle roofs: under 10–15 years is ideal

-

Tile or metal roofs: under 20–25 years

A newer roof can dramatically improve your ability to qualify for coverage and reduce premiums.

2. Roof Shape

Certain shapes stand up to wind better:

-

Hip roofs (sloped on all four sides) = best discount

-

Gable roofs = more vulnerable to wind uplift

If you have a hip roof, your discount is often instant.

3. Roof-to-Wall Connections

This is one of the biggest discount opportunities.

The three types are:

-

Toe nails (basic fastening, least wind resistant)

-

Clips (stronger)

-

Straps/Wrappers (highest level of wind resistance)

We verify how the trusses are attached to your walls and document it with photos for your insurer.

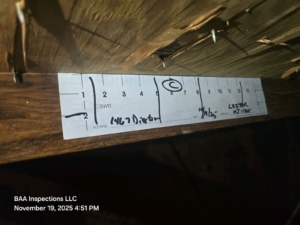

📸 Real Wind Mitigation Inspection Photo

Below is an image from an actual wind mitigation inspection performed this week by BAA Inspections:

Wind mitigation documentation performed by BAA Inspections — measuring roof deck nail spacing to confirm compliance with Florida insurance requirements.

4. Roof Deck Attachment

(This is what your photo documents.)

This part of the inspection measures:

-

Nail size (6d vs. 8d)

-

Nail spacing (how far apart they are)

-

Deck thickness

-

Whether attachment meets Florida’s wind-resistant building standards

Strong roof deck attachment reduces the risk of uplift during severe storms and is a major factor in wind mitigation savings.

5. Secondary Water Barrier (SWB)

This layer sits under the roof covering and helps prevent leaks if shingles are compromised.

Homes with SWB receive additional discounts.

6. Opening Protection (Windows, Doors, Garage Door)

Opening protection includes:

-

Impact-rated windows

-

Impact-resistant doors

-

Hurricane shutters

-

Reinforced or impact-rated garage doors

Homes with full opening protection often qualify for significant insurance savings.

How Much Money Can a Wind Mit Save?

Savings vary based on features, but common results include:

-

$150–$450/year for newer homes

-

$500–$1,000/year for homes with hip roofs & strong attachments

-

$700–$1,500/year for older homes with updated roofs

Many homeowners save more in the first year alone than the cost of the inspection.

Should Older Homes Still Get a Wind Mitigation?

Absolutely.

Even older homes may have:

-

Updated roofs

-

Added straps

-

Reinforced decking

-

Impact windows

-

Newly installed shutters

If any improvements were made since the home was built, a wind mit can capture savings you already qualify for.

Why Central Florida Homeowners Choose BAA Inspections

-

Thousands of inspections completed

-

Fast, clean, accurate reporting

-

Same-day wind mit & 4-point delivery

-

Insurance-compliant photo documentation

-

A $100,000 home warranty included with every full inspection

-

Local expertise across Orange, Lake, Seminole & Volusia counties

We make the process simple, fast, and accurate so you get every discount available.

If you want to lower your insurance premium or you need a wind mitigation to activate a new policy, we’re here to help.

You can schedule online 24/7 at BAAinspections.com, or call/text anytime with questions.

Leave a Reply

Want to join the discussion?Feel free to contribute!